In trading, timing is everything. Reversal trading is one of the most powerful ways to spot shifts in market direction before the crowd reacts.

At DAK Markets, traders use this technique to anticipate key turning points in forex, commodities, indices, and cryptocurrency markets — capturing opportunities others often overlook.

While continuation traders ride ongoing trends, reversal traders look for the exact moment when momentum fades, signaling the start of a new trend. This guide will teach you how to detect reversals, confirm their validity, and trade them confidently using tools available on DAK Markets.

What Is Reversal Trading?

Reversal trading involves identifying when a prevailing trend is about to change direction turning bullish to bearish, or vice versa. Unlike continuation patterns that confirm the current trend, reversals reveal moments when market sentiment shifts dramatically.

Reversal vs. Continuation Trends

| Type | Description | Example |

|---|---|---|

| Reversal Trend | Marks a complete change in direction (e.g., bearish to bullish). | A currency pair that has been falling begins forming higher lows. |

| Continuation Trend | The price temporarily consolidates before resuming its prior direction. | A brief pullback during a strong uptrend. |

Example: In November 2021, Tesla (TSLA) experienced a bearish reversal from $414.50 after showing overbought RSI levels and weak market sentiment.

How to Confirm a Reversal

Identifying a potential reversal is only half the battle — confirmation is what separates successful traders from guessers.

DAK Markets recommends combining multiple indicators and market context for validation.

1. Volume Confirmation

Rising volume supports the strength of a reversal.

When prices begin to turn on increasing volume, it signals institutional activity — the best confirmation for a new direction.

2. RSI & MACD

- RSI > 70 → Overbought → Possible bearish reversal

- RSI < 30 → Oversold → Possible bullish reversal

- MACD crossover → Early momentum signal for reversals

3. Candlestick Confirmation

Look for hammer, doji, and engulfing patterns at key support/resistance zones. These formations often reveal exhaustion in one direction and the start of a new trend.

Common Reversal Candlestick Patterns

1. Hammer Pattern (Bullish Reversal)

Appears at the bottom of a downtrend, signaling rejection of lower prices.

A strong bullish candle following the hammer confirms the trend reversal.

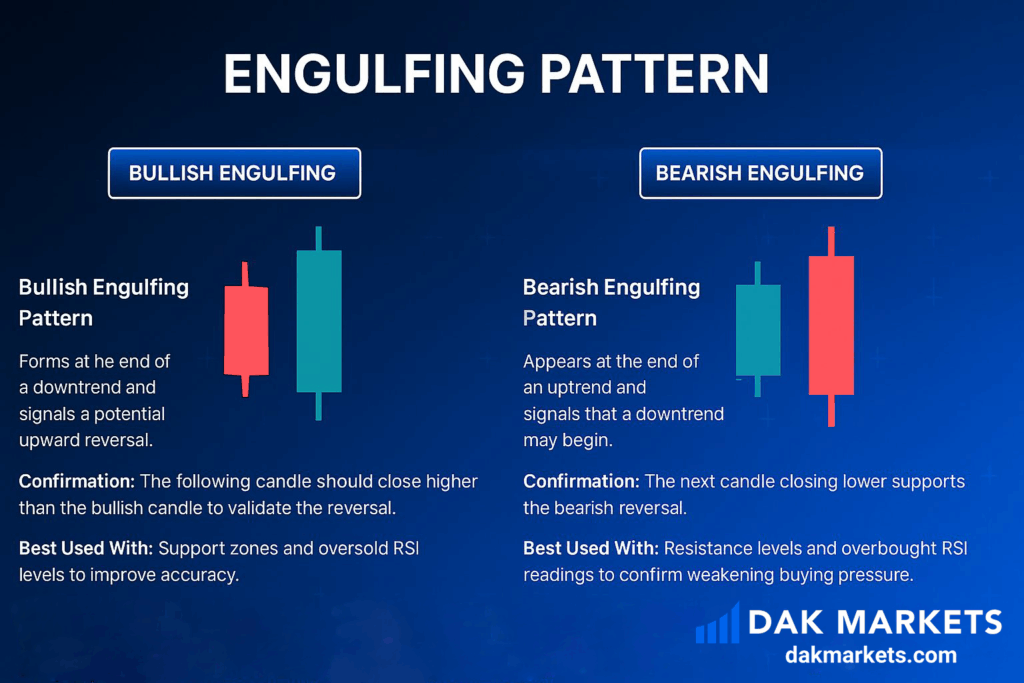

2. Engulfing Patterns

- Bullish Engulfing: Green candle fully engulfs the red one, signaling buyers taking control.

- Bearish Engulfing: Red candle engulfs the green, indicating selling strength.

3. Doji Candlestick

Shows market indecision, often appearing right before major reversals. The smaller the body, the stronger the signal — but confirmation from subsequent candles is essential.

Rules of Reversal Trading

Successful reversal trading isn’t guesswork — it’s about following proven structure and discipline.

Here are the DAK Markets Golden Rules of Reversal Trading:

- Confirm with Volume – Ensure significant changes accompany price action.

- Use Multiple Indicators – Combine RSI, MACD, and candlestick patterns.

- Wait for Pattern Completion – Avoid acting on partial setups.

- Watch Key Levels – Focus on reversals near support/resistance.

- Avoid Emotional Trades – Discipline prevents costly mistakes.

- Manage Risk – Always use stop-loss orders.

- Understand Context – Check for broader trend influence.

- Differentiate Pullbacks vs. Reversals – A pullback is temporary; a reversal reshapes the trend.

Integrating Reversal Trading with DAK Markets

Trading reversals is easier with DAK Markets’ advanced tools:

- Real-time Market Data: Instantly monitor price reversals across multiple instruments.

- TradingView Integration: Analyze patterns and confirm signals directly on your charts.

- Tight Spreads & Fast Execution: Perfect for capturing early entries without slippage.

- Comprehensive Education Hub: Access guides like this to master trading psychology and technical precision.

Whether you’re trading forex, indices, or commodities, DAK Markets gives you the precision and performance to act confidently at every turning point.

Conclusion: Turn Market Shifts Into Profit Opportunities

Reversal trading empowers traders to spot new opportunities early and avoid staying trapped in losing positions.

By combining volume confirmation, indicator analysis, and price action, you can trade like a professional and capitalize on market reversals with confidence.

At DAK Markets, our goal is to provide traders with the education, technology, and support they need to perform at their best — no matter the market condition.