Understanding the market environment is one of the most important skills a trader can develop. Whether the market is trending or ranging determines what strategies will work, what indicators are effective, and how risk should be managed. Many traders fail not because their strategy is bad, but because they apply the right strategy in the wrong environment.

In this guide, we break down the difference between a ranging market and a trending market, how to identify each, and how to adapt your approach to trade them effectively on DAK Markets.

What Is a Trending Market?

A trend occurs when price consistently moves in one direction — either upward (bullish) or downward (bearish). Trends form when financial markets are driven by sustained sentiment, macroeconomic events, institutional order flow, or strong liquidity imbalances.

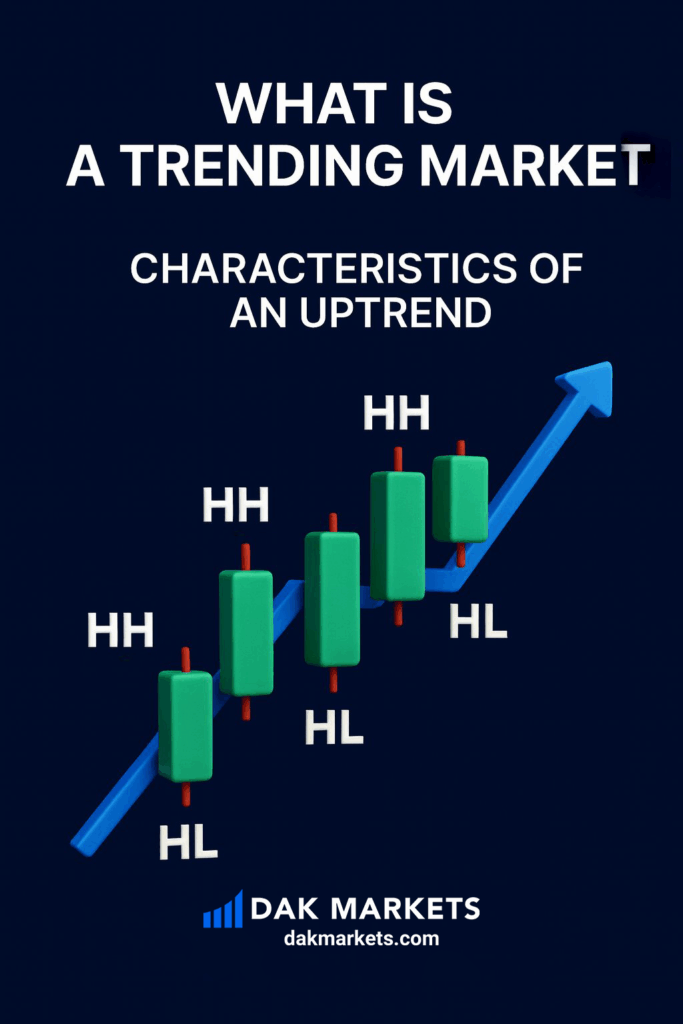

Characteristics of an Uptrend

An uptrend is defined by:

- Higher highs (HH)

- Higher lows (HL)

In other words, each swing high breaks above the previous one, and each pullback fails to reach the level of the previous swing low. This structure signals strong buying interest, often supported by fundamentals such as improving economic data, central bank expectations, or risk-on market sentiment.

Characteristics of a Downtrend

A downtrend is defined by:

- Lower lows (LL)

- Lower highs (LH)

Sellers dominate the market, and rallies are short-lived as institutions use them to add more short positions.

How Trends Break

A trend begins to weaken when:

- An uptrend violates the last swing low

- A downtrend violates the last swing high

This does not guarantee a full reversal but often signals a shift toward consolidation or range formation.

Best Indicators for Trend Trading

Trend traders commonly use:

- Moving Averages (MA 20/50/200)

- MACD

- Ichimoku Cloud

- Trendlines & Channels

These tools help identify momentum, continuation opportunities, and trend exhaustion.|

What Is a Ranging Market?

A range occurs when price oscillates between a clear support and resistance level. Buyers step in at the bottom of the range, while sellers defend the top.

Characteristics of a Ranging Market

- Price moves sideways without a clear higher-high or lower-low structure

- Candlesticks frequently reject both the top and bottom boundaries

- Volatility tends to be lower compared to trending markets

- Market sentiment is indecisive or waiting for new information (e.g., news releases, economic data, or central bank decisions)

Ranges often form before major breakouts, providing strong preparation for larger moves.

Support and Resistance in Ranges

The top of the range acts as:

- Resistance (sell zone)

The bottom acts as: - Support (buy zone)

Traders look to buy near support and sell near resistance until a breakout occurs.

Best Indicators for Ranging Markets

Mean-reversion indicators perform best:

- RSI

- Stochastic Oscillator

- Bollinger Bands

- Volume-Weighted Average Price (VWAP)

These tools help identify overbought/oversold conditions and contracting volatility.

Range vs Trend: Why This Matters for Your Strategy

The biggest mistake retail traders make is applying trend strategies in sideways markets or range strategies in trending markets. Each environment requires a completely different mindset.

Trend Trading Approach

Trend traders look to:

- Follow momentum, not fade it

- Enter on pullbacks (retracements to FVGs, OBs, or moving averages)

- Ride extensions toward liquidity pools

- Use wider stop-losses to account for volatility

Trend strategies aim to capture large directional moves, which can be extremely profitable when markets are trending strongly.

Range Trading Approach

Range traders focus on:

- Mean reversion: betting price will return to its average

- Shorting resistance & buying support

- Quick entries and exits

- Tight stop-loss placements

The challenge with ranges is timing — if a breakout occurs, range traders can quickly find themselves on the wrong side of the market.

How to Identify the Market Environment

Learning to interpret market structure correctly allows traders to adapt instantly. Here are simple yet effective steps:

1. Analyze Swing High/Lows

- HH + HL = uptrend

- LL + LH = downtrend

- Repeated equal highs/lows = range

2. Check Candlestick Behavior

- Strong impulsive candles → trending

- Choppy overlapping candles → ranging

3. Evaluate Volatility

- Expanding volatility → trend formation

- Contracting volatility → range or pre-breakout compression

4. Look for Market Drivers

Trends are often driven by:

- Central bank decisions

- Major economic data

- Geopolitical risk

- Large institutional rebalancing

Ranges occur during:

- Waiting periods before news

- Market indecision

- Low-volume sessions

Which Is Better: Trend Trading or Range Trading?

Neither approach is universally better — both have advantages depending on the market type.

Pros of Trend Trading

- High reward potential

- Cleaner price action

- Easier to identify direction

- Works well during macro-driven markets

Cons of Trend Trading

- Requires larger stop-losses

- Pullbacks can be unpredictable

- Trends eventually reverse

Pros of Range Trading

- Frequent trading opportunities

- Lower stop-loss requirement

- Works well during low-volatility sessions

Cons of Range Trading

- Breakouts can instantly invalidate setups

- Requires precision timing

- Slower profit accumulation

A skilled trader knows how to switch between the two.

How DAK Markets Helps You Trade Both Environments

DAK Markets provides traders with:

- Ultra-tight spreads for scalping in ranges

- Fast execution suited for breakout and trend strategies

- Deep liquidity to avoid slippage on major positions

- Advanced charting tools via cTrader

- Over 100+ assets including Forex, Indices, Metals, and Crypto

Whether you trade trends or ranges, execution quality matters — and that is where DAK Markets gives traders a competitive edge.

Final Thoughts

Understanding whether the market is trending or ranging is one of the most important decisions a trader can make before entering any position. Trends reward those who follow momentum, while ranges reward those who trade mean reversion. No strategy works in all conditions — adaptability is the true edge.

By combining structure reading, proper indicators, and high-quality execution from DAK Markets, traders can significantly improve their accuracy and long-term consistency.