In trading, numbers tell only part of the story. Behind every chart, position, and execution lies the most important factor of all: trader psychology. While strategies, indicators, and market conditions matter, long-term success is ultimately determined by how traders handle pressure, losses, and uncertainty.

One of the most common mistakes traders make is allowing a single losing day to dictate their emotions, decisions, and confidence. At DAK Markets, we believe that understanding and mastering trading psychology is just as important as technical or fundamental analysis.

This article explains why one red day doesn’t define your month — and how disciplined, consistent traders think differently.

The Emotional Trap of Short-Term Results

Human psychology is wired for immediate feedback. When traders experience a losing day, the brain often exaggerates its importance. This can lead to emotional reactions such as:

- Overtrading to “make it back”

- Abandoning a proven strategy

- Increasing risk beyond planned limits

- Doubting long-term edge after short-term variance

In reality, a single trading day is statistically insignificant within a properly executed trading plan. Markets are probabilistic. Even the most profitable strategies experience losses — sometimes several in a row.

Professional traders understand this. Emotional traders fight it.

Why Losses Are a Normal Part of Trading

Every trading system operates within probabilities, not certainties. A strategy with a strong edge can still produce losing days, weeks, or even months without being broken.

What separates professional traders is not the absence of losses, but their ability to stay consistent despite them.

Key realities of trading losses:

- Losses do not mean failure

- Losses do not invalidate a strategy

- Losses are required to realize long-term expectancy

At DAK Markets, we emphasize execution over outcome. Focusing on process rather than daily P&L allows traders to remain objective and disciplined — especially during drawdowns.

Consistency Over Perfection

Many traders aim for perfection: no losses, constant wins, flawless execution. This mindset is unrealistic and dangerous.

Consistency is far more important than perfection.

A consistent trader:

- Follows predefined risk parameters

- Executes the same strategy repeatedly

- Accepts losses without emotional reaction

- Evaluates performance over weeks and months, not hours

A trader who stays consistent through losing days is far more likely to achieve sustainable profitability than one who constantly changes approach after every setback.

How One Losing Day Can Destroy a Month — If You Let It

Ironically, one losing day often becomes destructive not because of the loss itself, but because of what follows.

Common psychological spirals include:

- Revenge trading

- Doubling position size

- Trading outside planned sessions

- Ignoring risk rules

This behavior turns a manageable loss into a larger drawdown. The market didn’t cause the damage — emotions did.

Professional traders recognize that the goal after a losing day is not recovery, but stability.

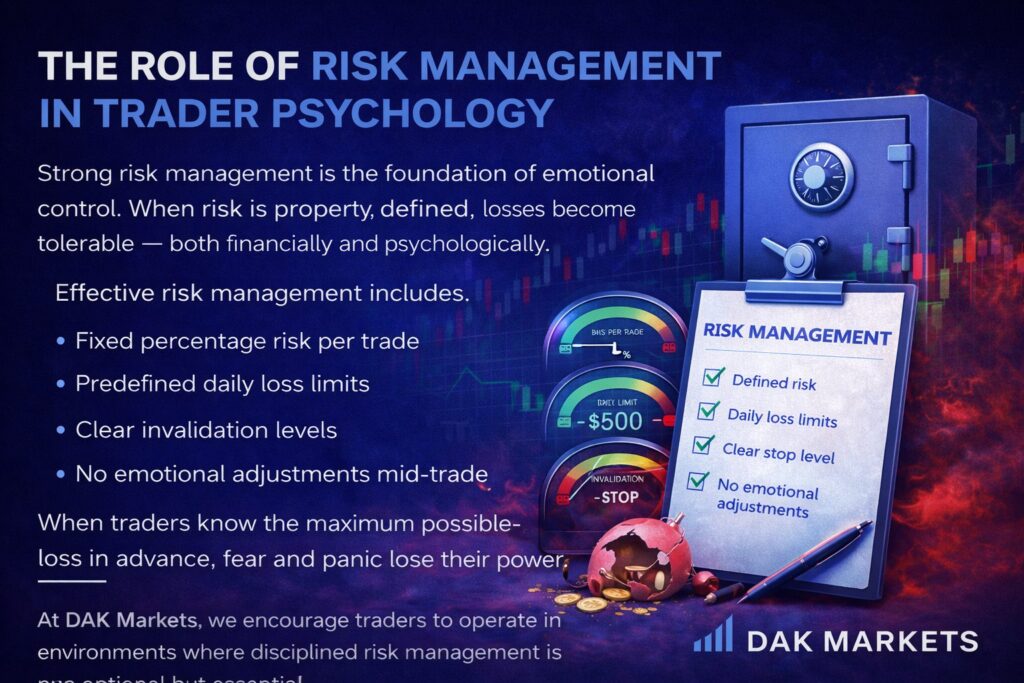

The Role of Risk Management in Trader Psychology

Strong risk management is the foundation of emotional control. When risk is properly defined, losses become tolerable — both financially and psychologically.

Effective risk management includes:

- Fixed percentage risk per trade

- Predefined daily loss limits

- Clear invalidation levels

- No emotional adjustments mid-trade

When traders know the maximum possible loss in advance, fear and panic lose their power.

At DAK Markets, we encourage traders to operate in environments where disciplined risk management is not optional, but essential.

Long-Term Thinking: The Professional Mindset

Professional traders think in series of trades, not individual outcomes. A single trade or day has no meaning outside the context of a larger sample size.

Instead of asking:

“Did I make money today?”

They ask:

- Did I follow my rules?

- Did I execute my plan correctly?

- Did I manage risk appropriately?

This shift in thinking transforms trading from an emotional rollercoaster into a structured business.

Building Emotional Resilience as a Trader

Trader psychology is not fixed — it can be trained and strengthened over time.

Key habits that build emotional resilience:

- Journaling trades and emotions

- Reviewing performance weekly instead of daily

- Taking breaks after emotionally charged sessions

- Separating self-worth from trading results

The goal is not to eliminate emotion, but to prevent emotion from influencing decisions.

Why Discipline Matters More Than Motivation

Motivation is temporary. Discipline is permanent.

Motivated traders trade when they feel confident. Disciplined traders trade according to rules — regardless of emotion.

Discipline allows traders to:

- Stop trading after reaching limits

- Avoid impulsive decisions

- Maintain consistency during drawdowns

At DAK Markets, discipline is viewed as a core trading skill, not a personality trait.

Final Thoughts: One Day Does Not Define You

Every trader experiences losing days. What matters is not the loss, but the response.

One losing day does not define your month.

One losing trade does not define your strategy.

One setback does not define your career.

Success in trading comes from patience, consistency, and emotional control — qualities that develop over time through experience and discipline.

Stay focused.

Stay consistent.

Trust the process.

About DAK Markets

DAK Markets provides a professional trading environment built for traders who value discipline, transparency, and long-term performance. Our focus is not on hype, but on creating conditions where serious traders can operate with confidence and control.