Understanding the Financial Markets

Financial markets form the foundation of the global economy. Every day, trillions of dollars are exchanged as traders, investors, institutions, and governments buy and sell assets — from currencies and commodities to stocks and bonds.

At DAK Markets, we believe understanding how these markets function is the first step toward trading success. Whether you’re a beginner or a seasoned trader, mastering these fundamentals gives you the confidence to navigate price movements and global events effectively.

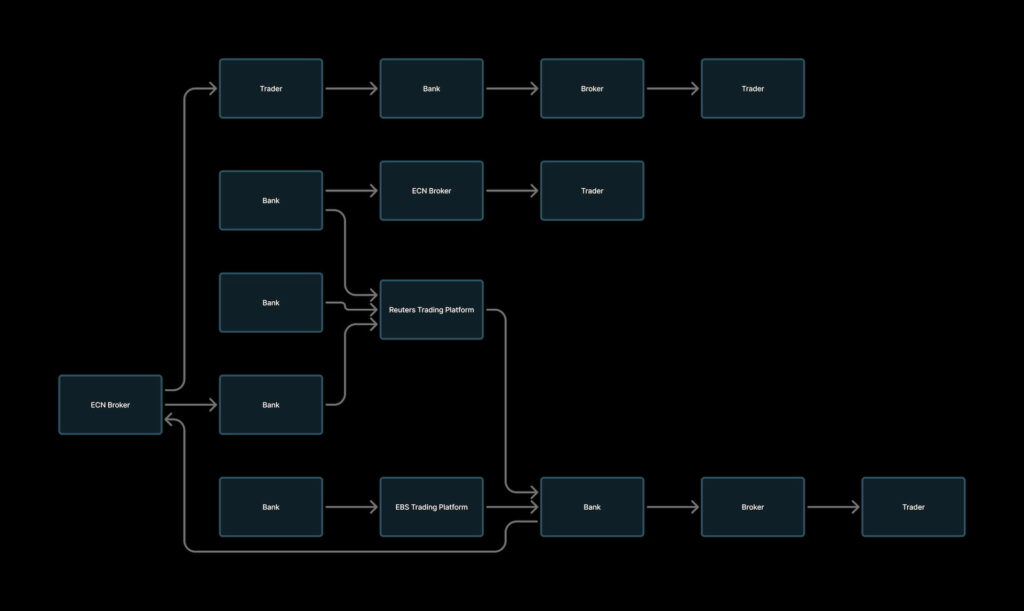

Visual representation of liquidity flow between banks, ECN brokers, and traders in a decentralized Forex market.

What Are Financial Markets and Institutions?

A financial market is a system that enables the exchange of financial assets between buyers and sellers. These assets include:

- 💱 Foreign currencies (Forex)

- 📈 Stocks and indices

- 🛢️ Commodities

- 💰 Bonds and derivatives

The purpose of these markets is to connect capital with opportunity — companies seek funding to grow, while investors and traders seek returns.

Financial institutions, such as banks, brokers, and investment firms, act as intermediaries that make these transactions possible in a regulated, efficient environment.

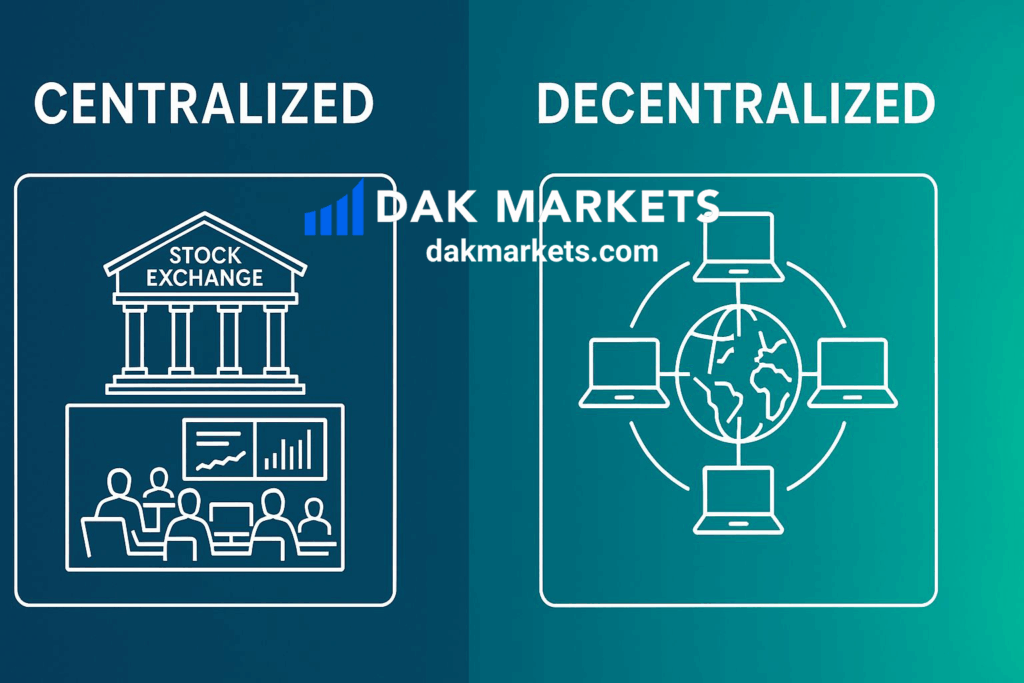

Centralized vs. Decentralized Markets

There are two primary types of financial market structures: centralized and decentralized.

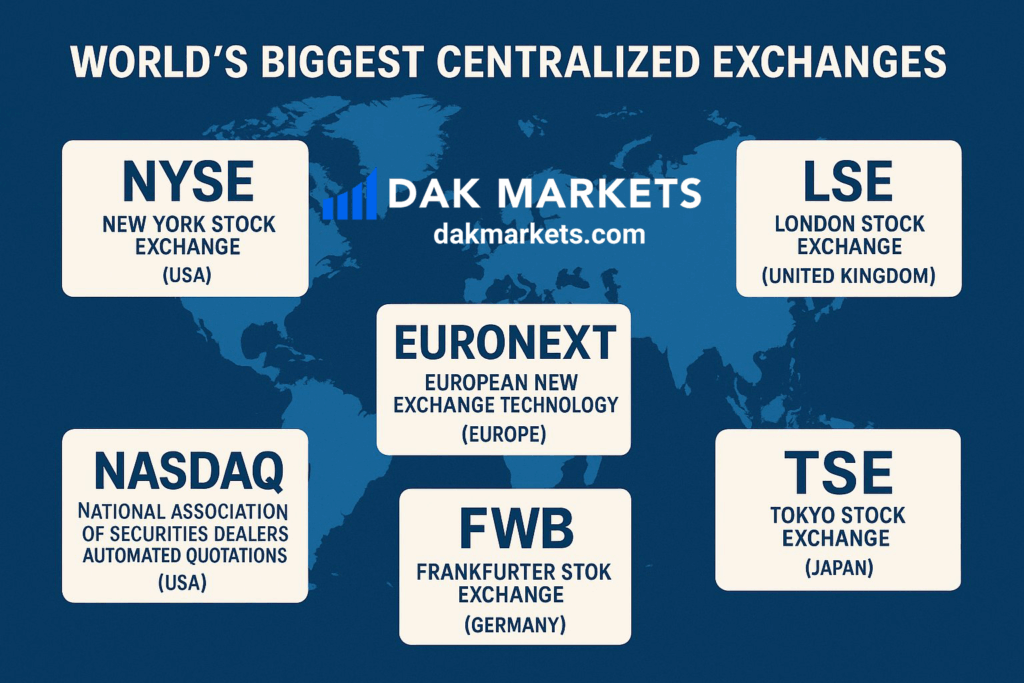

Centralized Markets

Centralized exchanges operate as a single location where transactions occur. They are highly regulated, transparent, and standardized — with fixed trading hours and uniform pricing.

Examples:

- NYSE – New York Stock Exchange 🇺🇸

- NASDAQ – National Association of Securities Dealers Automated Quotations 🇺🇸

- LSE – London Stock Exchange 🇬🇧

- TSE – Tokyo Stock Exchange 🇯🇵

- Euronext – European Stock Exchange 🇪🇺

These are ideal for large corporations and investors seeking structure and liquidity.

Decentralized Markets

Decentralized markets, like Forex, have no central physical location. Trades occur directly between participants through digital platforms — connecting buyers and sellers worldwide.

This structure allows for:

- 24-hour trading, five days a week

- Greater flexibility in trade sizes and conditions

- Competitive pricing between brokers

- Accessibility for retail traders through platforms like cTrader offered by DAK Markets

Decentralization gives traders more freedom and control — but also requires a clear understanding of market liquidity and volatility.

What Is the OTC (Over-the-Counter) Market?

The OTC market is a decentralized marketplace where trading happens directly between participants instead of through a central exchange. Transactions are conducted via:

- Electronic trading platforms

- Direct broker-to-client systems

- Communication channels like email or internal networks

In the OTC Forex market, traders exchange currencies without needing a centralized exchange, ensuring global liquidity and near-instant execution — one of the key benefits of trading with DAK Markets.

Forex: The World’s Largest Financial Market

The foreign exchange market (Forex) is the largest and most liquid market in the world, with over $7.5 trillion traded daily (source: BIS, 2022).

It operates 24 hours a day, following three main global sessions:

- Asian Session

- European Session

- North American Session

Through these overlapping sessions, traders can access price movements influenced by global events in real time.

Unlike stock markets, Forex is fully decentralized — there is no “Forex exchange.” Instead, trades occur electronically through networks of banks, brokers, and liquidity providers.

At DAK Markets, we connect traders directly to this global ecosystem through raw spreads, real market execution, and institutional-grade liquidity.

Comparison for Retail Traders

Most modern traders choose decentralized markets like Forex due to their flexibility, accessibility, and potential for short-term opportunities.

The Role of Brokers in Financial Markets

A broker serves as the bridge between you and the market. Reliable brokers like DAK Markets provide:

- Advanced platforms (like cTrader)

- Access to institutional liquidity

- Real-time execution with no dealing desk intervention

- Transparent pricing and low-cost trading conditions

Choosing the right broker is as critical as choosing your trading strategy.

At DAK Markets, we are committed to fair execution, client fund safety, and educational support — helping you trade confidently in global financial markets.

Final Thoughts

Understanding financial markets is more than theory — it’s about realizing how the global economy moves and how traders capitalize on these movements daily.

From centralized exchanges to the decentralized Forex world, every market plays a unique role in shaping global finance.

At DAK Markets, our mission is to make these opportunities accessible to every trader — through cutting-edge platforms, tight spreads, and professional education.

✅ Start Trading the Global Markets Today

🚀 Create your Live Trading Account or Demo Account at www.dakmarkets.com

🎓 Explore more lessons in our DAK Markets Academy

📞 Connect with our team anytime for expert assistance