Introduction: The Power and Risk of Margin Trading

Margin trading is one of the most powerful tools in modern financial markets. It allows traders to open larger positions with a smaller deposit, amplifying both potential profits and potential losses.

At DAK Markets, we believe that understanding how margin works is essential for sustainable trading. Many traders see leverage as an advantage — and it can be — but only when combined with smart risk management.

In this guide, we’ll break down margin, leverage, account equity, and margin calls, and show you how to manage your trading positions responsibly to protect your capital.

⚙️ What Is Margin Trading?

Margin trading allows you to control a larger position than the funds you have available in your account. The portion of your capital used to open that position is called margin — essentially a security deposit required by your broker.

Let’s take a simple example:

Suppose you want to trade 1 standard lot of EUR/USD, which equals $100,000 in notional value.

If your broker requires a 2% margin, you only need $2,000 in your account to open the trade.

That $2,000 acts as collateral for your position — ensuring that if the market moves against you, your broker can cover potential losses.

Margin requirements vary depending on the:

- Instrument traded (e.g., Forex, indices, metals, or cryptocurrencies)

- Leverage ratio offered

- Regulations and account type

At DAK Markets, we offer flexible leverage options to help traders maximize efficiency while maintaining proper control over their risk.

📊 How Margin and Leverage Work Together

Margin and leverage are two sides of the same coin.

Where margin is the amount of money you need to open a trade, leverage determines how much exposure that margin gives you.

For example:

- Leverage of 1:100 means that for every $1 in your trading account, you can control $100 in the market.

- A $1,000 account balance would allow you to open positions worth up to $100,000 in notional value.

However, leverage magnifies both gains and losses. While it can accelerate profits, it can also quickly deplete your capital if not used properly.

That’s why professional traders at DAK Markets combine low leverage with consistent risk management — ensuring that no single trade can wipe out their equity.

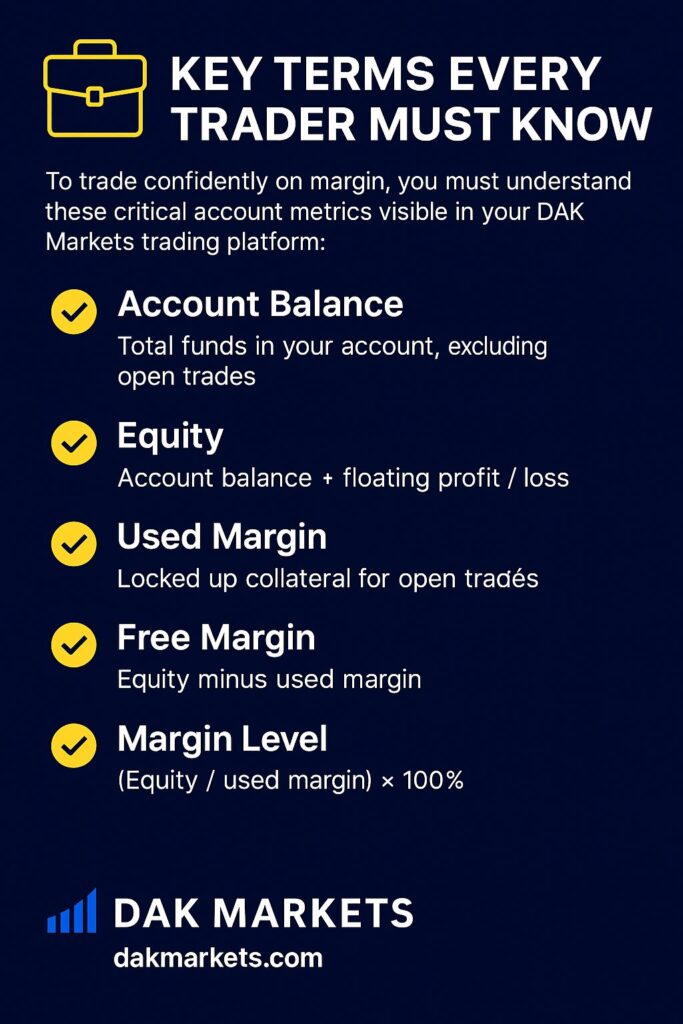

💼 Key Terms Every Trader Must Know

To trade confidently on margin, you must understand these critical account metrics visible in your DAK Markets trading platform:

1. Account Balance

Your balance reflects the total amount of funds in your account, excluding any open trades.

If you deposit $5,000 and haven’t opened a trade yet, your balance remains $5,000.

Once you close a position, your realized profit or loss will update your account balance accordingly.

2. Equity

Your equity represents your real-time account value, including open trades.

It constantly fluctuates with the market’s movement.

- If your open positions are in profit, your equity increases.

- If they are in loss, your equity decreases.

Formula:

Equity = Balance + (Floating Profit / Loss)

Equity gives you a real picture of your account’s health and is more important than balance when it comes to maintaining sufficient margin.

3. Used Margin

Used margin is the total amount locked as collateral for all your open trades.

This portion of your funds cannot be used for opening new positions until those trades are closed.

4. Free Margin

Free margin (or available margin) is the capital left in your account that’s not tied up in trades.

It determines your capacity to open additional positions or absorb drawdown.

Formula:

Free Margin = Equity – Used Margin

If your free margin drops to zero, you won’t be able to open any new trades — and your account enters the margin callzone.

5. Margin Level

Margin level is a percentage ratio that shows how much equity you have compared to your used margin.

Formula:

Margin Level = (Equity / Used Margin) × 100

For example:

If your equity is $5,000 and your used margin is $1,000, your margin level is 500%.

A higher margin level indicates a healthier account. Most brokers, including DAK Markets, use margin levels to trigger margin calls and stop-out procedures.

⚠️ Margin Call vs. Stop-Out Level

These two terms are vital for risk control:

Margin Call

A margin call is a warning signal that your account equity has dropped too low relative to your open positions.

It typically occurs when your margin level reaches 100%, meaning your equity equals your used margin.

When this happens, you cannot open new trades until you:

- Close existing positions, or

- Deposit additional funds to restore your margin.

It’s important to note that a margin call does not close your trades automatically — it simply warns you that your available margin is almost exhausted.

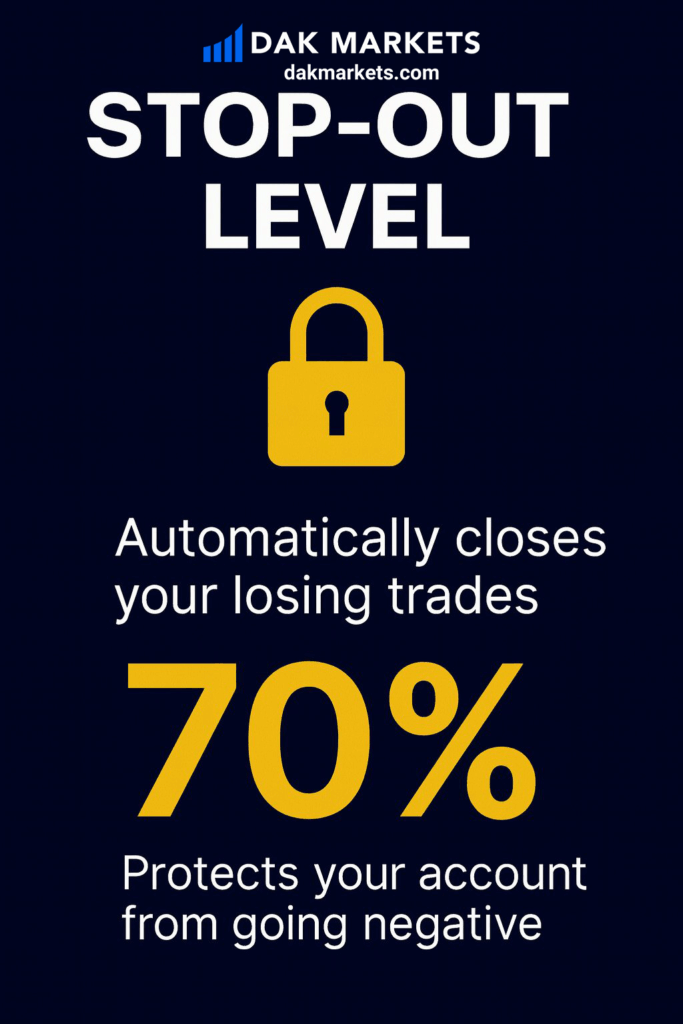

Stop-Out Level

A stop-out level is the point at which the system automatically closes your losing trades to protect your account from going negative.

For example, if your broker’s stop-out level is 70%, once your margin level falls below that threshold, trades will start closing — beginning with the largest losing position — until your account recovers above the limit.

This mechanism helps ensure that traders never owe more money than they deposited.

🧠 Floating vs. Realized Profit and Loss (PnL)

- Floating PnL (unrealized): The profit or loss on open trades. It fluctuates as prices move.

- Realized PnL: The profit or loss from trades that have been closed. This amount is added to or deducted from your account balance.

Many inexperienced traders make the mistake of treating floating profit as realized capital — leading to overexposure.

At DAK Markets, we encourage traders to focus on equity, not balance, when evaluating real account performance.

🔒 How to Avoid Margin Calls

Margin calls can be stressful, but they are completely avoidable. Follow these simple principles to protect your account:

- Use conservative leverage.

Even though DAK Markets offers high leverage for flexibility, professionals rarely exceed 1:20 on most setups. - Always trade with stop losses.

Predetermine your risk on every trade and stick to it. - Monitor your margin level.

Keep it above 300% at all times for safety. - Avoid trading during high-impact news.

Economic releases can cause price slippage, leading to unexpected losses. - Diversify your positions.

Don’t risk all your capital on one correlated trade or asset.

Proper risk management is the difference between surviving and thriving in leveraged trading.

🚀 Why Margin Trading at DAK Markets Is Different

At DAK Markets, we prioritize transparency, security, and education.

We provide:

- Flexible leverage for Forex, indices, and commodities.

- Negative balance protection to safeguard your capital.

- Advanced margin monitoring tools within our trading platforms.

- Educational resources designed to help traders understand the mechanics of margin, equity, and risk.

Our mission is to ensure that every trader — beginner or professional — understands not only how to make money but how to protect it.

📈 Final Thoughts: Trade Smarter with DAK Markets

Margin trading is a double-edged sword — it can multiply your profits or accelerate your losses.

By learning how margin, leverage, and equity work together, you can trade with confidence and discipline.

At DAK Markets, we believe knowledge is your greatest form of leverage.

Use it wisely, manage your risk, and let your strategy — not emotion — drive your trades.

✅ Start Trading with Confidence

Join DAK Markets today and experience professional-grade trading conditions, advanced tools, and tight risk control.

Trade smarter, trade safer, and grow your capital the right way.