Trading is simple, but not easy. This statement perfectly summarizes the journey of every aspiring trader. At DAK Markets, we created the Trader’s Journey — a comprehensive educational initiative designed to guide beginners through every step of their trading development, from learning the fundamentals to applying professional strategies in live markets.

Many people enter trading hoping for quick profits, only to realize it requires discipline, emotional control, and ongoing education. In this guide, we’ll explore what trading is, how it differs from investing, who can become a trader, and what steps you can take to start your journey the right way.

🧭 What Is Trading?

Trading involves buying and selling financial assets to profit from price fluctuations. Traders speculate on the rise or fall of asset prices without necessarily owning them. These assets include forex, commodities, indices, stocks, and cryptocurrencies, all of which are available through the DAK Markets platform.

Unlike long-term investors who hold positions for years, traders operate in shorter time frames — from minutes to weeks — focusing on quick price movements.

They use technical analysis, market psychology, and risk management to find consistent, repeatable opportunities in the market.

⚙️ What Trading Involves

Successful trading requires mastering several disciplines:

- Market analysis: Reading price charts, identifying trends, and using indicators like RSI or Moving Averages.

- Strategy development: Building a clear, backtested approach to when and how you trade.

- Risk management: Limiting losses through stop-losses and maintaining proper position sizing.

- Psychological control: Staying consistent, disciplined, and emotionally stable during wins and losses.

Trading is not gambling — it’s a structured business model. Consistency, discipline, and preparation form the foundation of success.

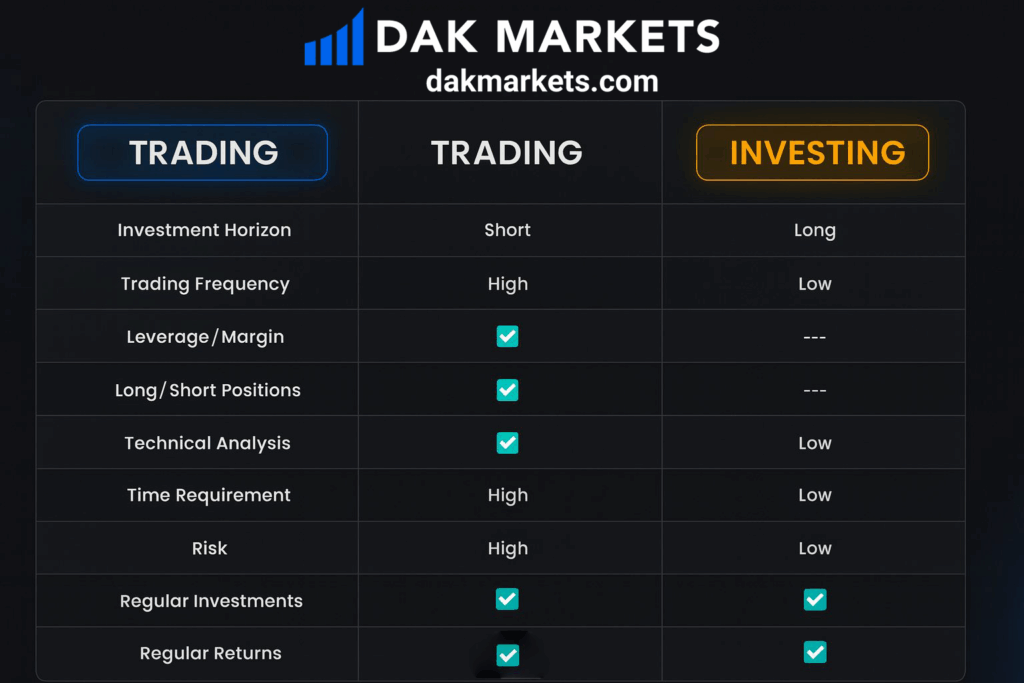

📈 Trading vs. Investing: What’s the Difference?

Many beginners confuse trading with investing, but there’s a key distinction.

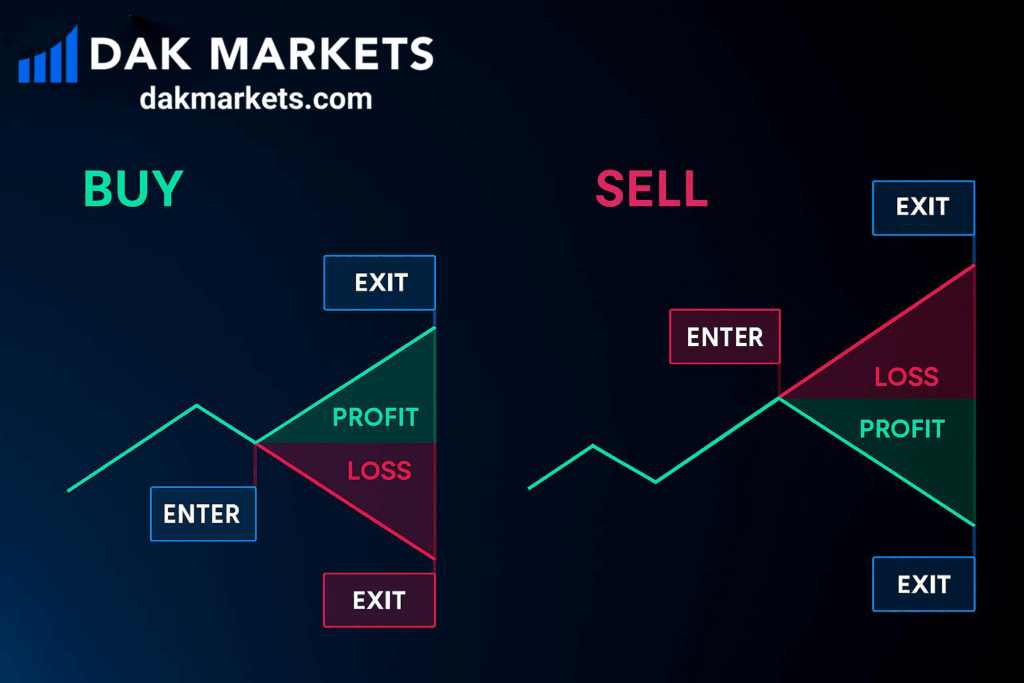

Investors aim to own assets long-term, hoping they appreciate over time. Traders, on the other hand, speculate on short-term price changes and can profit whether markets rise or fall.

Traders can take long positions (buy low, sell high) or short positions (sell high, buy low). This flexibility allows profits in both bullish and bearish markets.

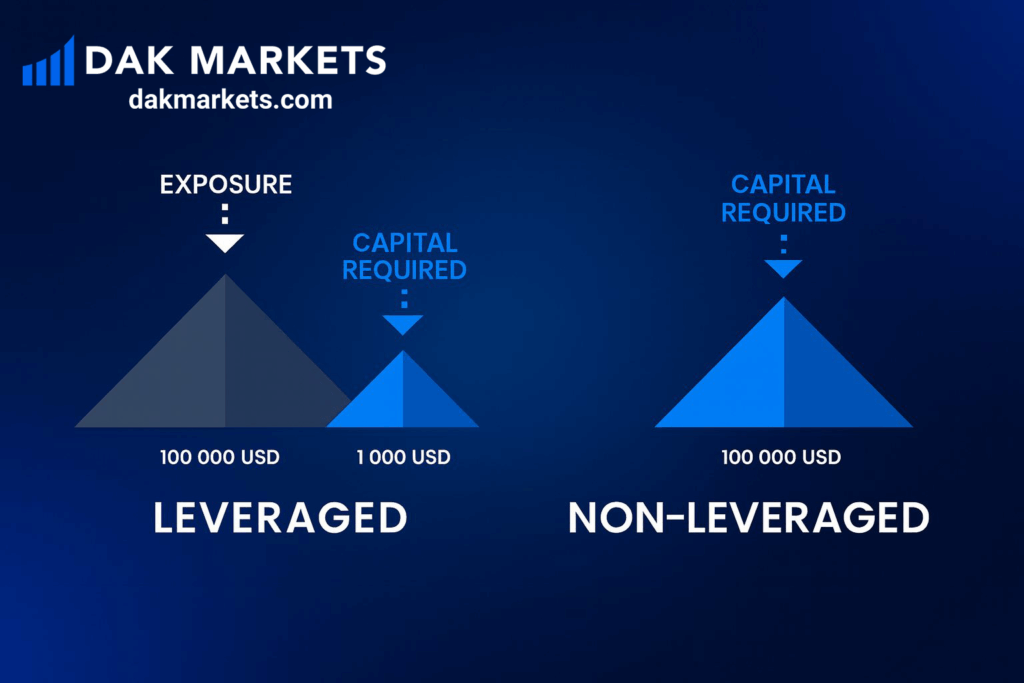

⚡ The Power of Leverage

Leverage is one of the biggest advantages in trading — but it must be used wisely.

It allows traders to control large positions with a relatively small amount of capital. For example, with 1:100 leverage, a $1,000 deposit lets you control $100,000 worth of trading volume.

However, leverage magnifies both profits and losses. Risk management is crucial — traders should never risk more than 1–2% of their capital on a single trade.

👥 Who Can Become a Trader?

At DAK Markets, we believe anyone can become a trader — regardless of background, education, or experience.

Success in trading doesn’t depend on having a financial degree but on developing key traits:

- Perseverance: Accepting losses as part of the process and pushing through challenging periods.

- Discipline: Following your trading plan and avoiding emotional decisions.

- Humility: Acknowledging mistakes and constantly learning.

- Curiosity: Staying eager to explore strategies, markets, and techniques.

Many successful traders come from completely unrelated fields — from athletes to engineers — proving that dedication and mindset matter more than background knowledge.

💰 Expected Earnings of Traders

One of the biggest misconceptions about trading is expecting fast profits. In reality, trading rewards patience and long-term consistency.

The 90/90/90 Rule suggests that 90% of traders lose 90% of their money within the first 90 days — usually because they skip the learning phase and trade emotionally.

At DAK Markets, we encourage traders to focus first on education and discipline, not instant profits. Over time, those who follow a structured learning approach, practice risk management, and refine their strategies can achieve sustainable success.

Avoid unrealistic expectations promoted by online influencers. Trading is not a “get rich quick” scheme — it’s a skill that compounds over years of learning and refinement.

🚀 Where to Start

If you’re new to trading, the best way to begin is through demo trading — a simulated environment where you can practice without risking real money.

With DAK Markets’ demo accounts, you can:

- Learn to navigate trading platforms

- Execute trades in real market conditions

- Understand how margin, leverage, and stop-losses work

- Build and test your first strategies safely

Once you feel confident, you can transition to a live account with a clear plan and proper risk control.

🌐 Why Start with DAK Markets

DAK Markets offers a world-class platform designed for both beginners and experienced traders:

- Access to multiple markets – Forex, Indices, Commodities, Stocks, and Cryptocurrencies

- Transparent trading environment with institutional-grade execution

- Advanced tools and analytics for both technical and fundamental traders

- Educational resources that help you develop the mindset and strategy of a professional trader

We’re committed to helping traders not only enter the markets but thrive in them — through education, consistency, and long-term support.

🧩 Conclusion

Trading can be one of the most rewarding careers or hobbies — but it requires patience, discipline, and an ongoing commitment to learning.

By understanding the foundations, distinguishing trading from investing, and developing the right mindset, you’ll build a path toward consistent results.

Whether you’re just starting or looking to refine your strategy, DAK Markets provides the technology, guidance, and educational tools to help you trade confidently in global markets.

Start your trading journey today at dakmarkets.com — your gateway to mastering the art of trading.