Why Your Mind Is Your Greatest Enemy in Trading – And How to Beat It | DAK Markets

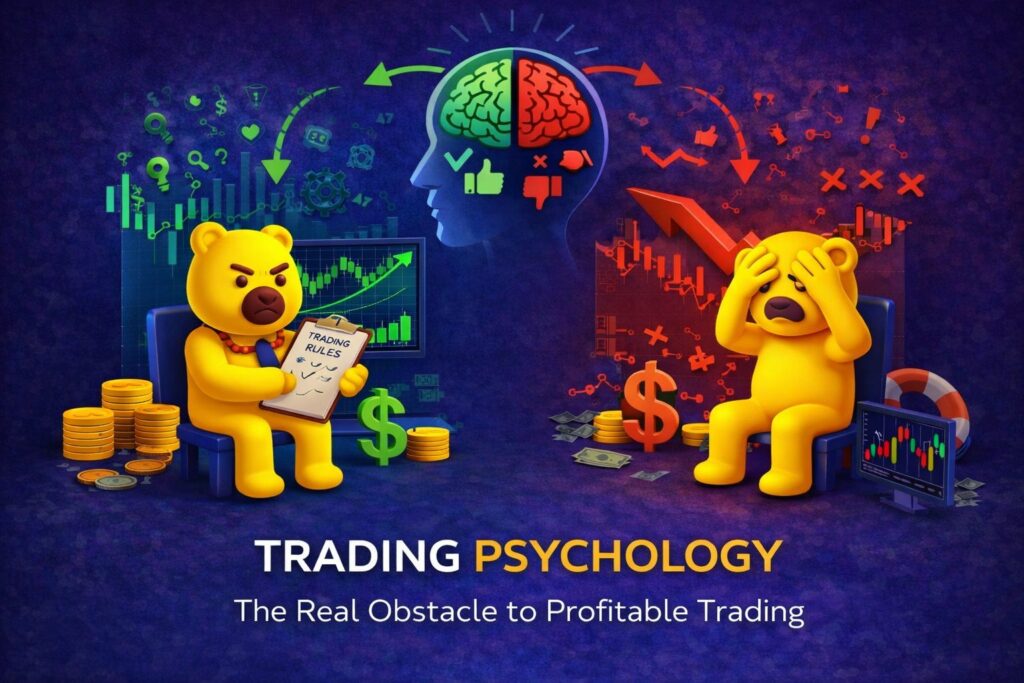

Most traders believe the market is their biggest challenge. In reality, the true battle happens internally. Fear, greed, ego, impulsiveness, and overconfidence often influence decisions more than strategy itself. Long-term success in forex trading doesn’t just require technical skill — it requires psychological discipline. Mastering the market starts with mastering your mind.